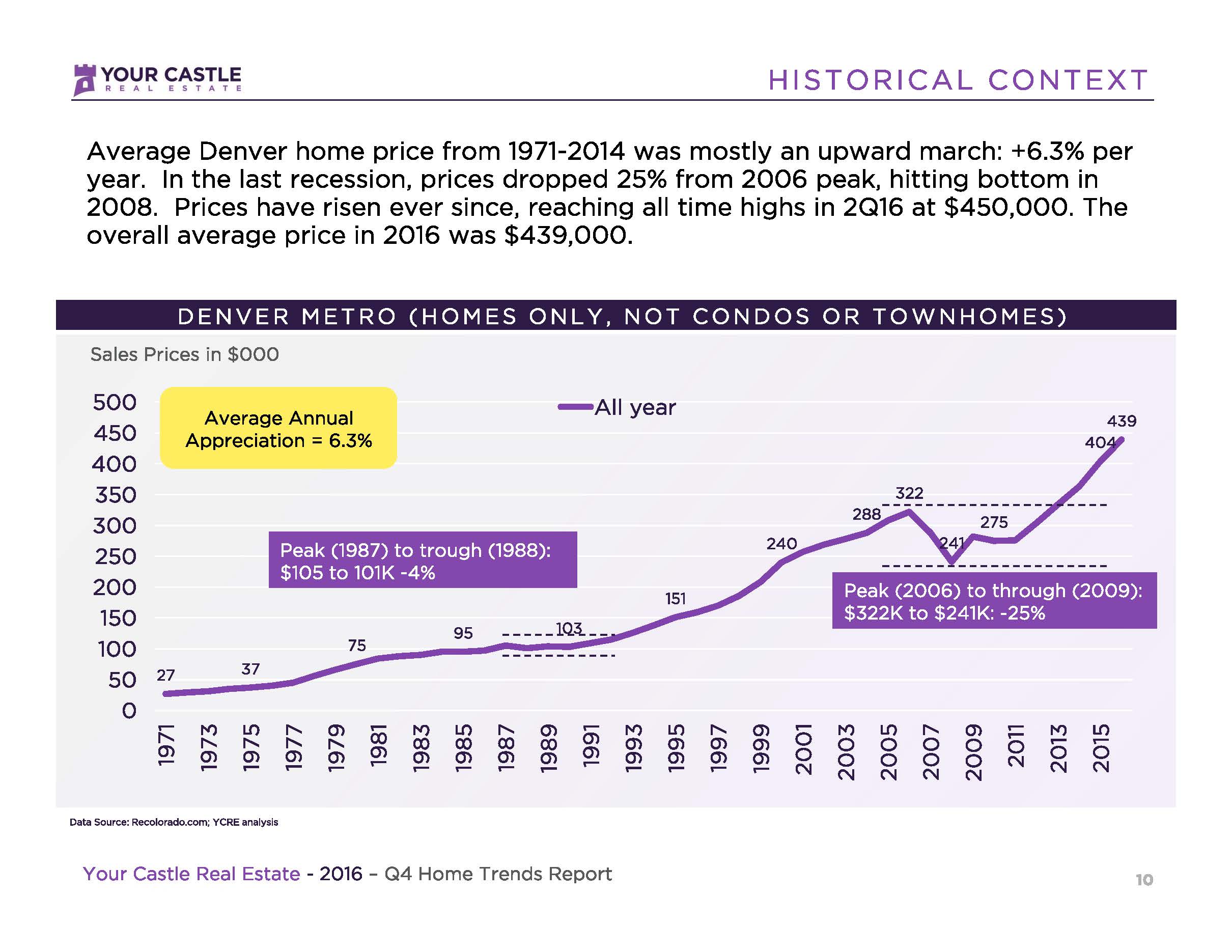

With an ever-growing population and housing demand, owning a home in Denver has historically been a pretty good investment:

(w/ inflation appreciation +2% annually)

These are the 6 steps to buy a home in Denver:

Parties Involved:

Buyers Agent: The person that represents your interests when purchasing real estate.

Listing Agent: The person that represents the interests of the sellers when selling real estate.

Lender: The person that provides your financing so that you are capable if purchasing real estate.

Title Company: The company that provides free and clear title to the new owner, and provides title insurance to safeguard the buyers’ claim to title.

1.) Pre-approval

Unless you plan to pay in cash, getting pre-approved by a lender will be the most important part of starting the home-buying process. No offer will be taken seriously without a pre-approval letter, so it is important to have this in hand as well as an accurate idea of all of the costs involved to purchase a home.

It’s also really important to choose a lender that communicates well, and specializes in the local market. Local mortgage lenders are usually preferable to large-banks. Here in the Denver market, large sized banks do not have a stellar reputation for getting deals closed on time. For this reason, it’s important that the lender who writes your pre-approval letter has a local reputation and effective communication skills. Listing agents often like speaking with the lender to ensure their ability to close the loan. Sometimes, this means a phone call at 6:00 or 7:00 pm- that sort of communication doesn’t come from someone working a strict 9-5 with a 1-800 number.

2.) Search

Once you fully understand all of the costs involved in your desired price range, it’s time to set up a search in the MLS. We’ll go through every criteria that is important to you and set up a custom search tailored to your interests. Many buyers start their search at the top of their price range- I recommend starting a bit lower. Searching for homes 10-20k below your highest purchase limit will give you an advantage when making offers. If you plan on purchasing a home that is turn-key (looks nice), then you you’ll need the wiggle room to be able to offer a little higher than listing price.

3.) Offer

Getting your offer accepted will probably be the most challenging part of the Denver buying process. It isn’t uncommon for a nice home to receive 5-10 offers over a weekend. Understanding the different reasons why sellers choose one offer over another will put you ahead of 90% of other buyers in the market. I wrote something on this called 10 Denver Buying Strategies. Make sure you read and understand all of the different buying strategies before making an offer!

Part of making an offer is supplying earnest money to be held by the title company. For houses under 500k the earnest money is usually about 1% of the purchase price. This money is given to the Title company by the buyer within a few days of their offer being accepted. Earnest money is held in an escrow account and credited to the buyer at closing. If the parties do not make it to the closing table, the Buyer has the legal right to reclaim their earnest money provided they have not violated any of the deadlines in the agreement. None of my buyers have lost their earnest money.

4.) Inspection

Once the house is under contract, we need to make sure that it’s in the condition we think it is in. A home inspection will usually cost $300-$500, and is invaluable in determining the house’s condition. I recommend using a very experienced inspector that will be able to identify any areas of concern. I like to use Ken Clark from Home Systems Data. With 20+ years of residential construction experience, Ken has the skills and knowledge to give his clients an incredibly detailed analysis of the home’s condition. Recently Ken exceeded expectations for one of my buyers by writing a very long and detailed inspection report for a property we had under contract. Because of Ken’s report, I advised my client to withdraw from contract and offer on a different property. We were able to purchase another home in better condition. Due to Ken’s analysis, my client was able to avoid purchasing a home with $20,000 in defects. It’s easy to get excited and eager to buy a home you love, but it’s important to take a step back, and make sure that this property is going to be good investment.

If the house is old and has an old sewer line- as many in Park Hill tend to- it’s also important to get a sewer scope. These cost around $100 but are definitely worth doing to avoid buying a home and then finding out after purchase that replacing the sewer line will be $10,000!

5.) Appraisal

The appraisal is ordered by the lender and usually paid for by the Buyer. An appraiser is a trade-professional whose job is to evaluate the value of real estate based on comparable properties and market conditions. The appraisal is required by the lender to ensure the home is worth the purchase price that the lender is financing. This is necessary for the lender because the home is collateral for the loan, so it is important to the lender that the home is worth at-least as much as its purchase price. If the home appraises for less than the contracted purchase price, the Seller and Buyer may agree to renegotiate, or terminate the agreement. The appraisal is the last “moment of truth” before closing. If we can get passed appraisal, the chances of closing this deal are extremely high.

6. Close

Closing usually takes place at the title office. I’ll be there with you along with the closing professional for the title company. The seller may choose to close at the same time as the Buyer or at a different time. Possession to the property will usually take place right after closing, or a few days later depending on the terms of the contract. The title company will provide you with documents pertaining to your new home ownership right after closing. You may receive a notice in the mail a few weeks after closing asking for money to record the deed. Deed recording is a common scam, your deed was already recorded when you closed!

Hopefully this Denver Buying Guide helps you understand the basics of the home-buying process. Remember, I am never too busy for your questions. Feel free to call or txt anytime.

-Erik Carman. 720-663-8999