Every few months, a new real estate guru comes to Denver to teach easy ways to “get rich quick” with real estate. While great in theory, many of these programs don’t account for the specific conditions of the Denver real estate market. Most of these “gurus” preach very generic forms of real estate investing: such as wholesaling and/or flipping properties. These programs can work well in certain markets: Denver isn’t one of them.

The Denver market is unique when it comes to investing in real estate. Our market’s low inventory and high demand means the type of flipping seen on HGTV- where an investor renovates a home and quickly sells for 15-20% profit- are hard to find. However, you can still make a 15-20% return on your investment, just in different ways. Let’s take a look at how to identify Denver real estate investment opportunities and the best strategies that you can use to add $20,000-$50,000 a year to your income or net-worth without using a hard money lender.

Investing in Denver Real Estate.

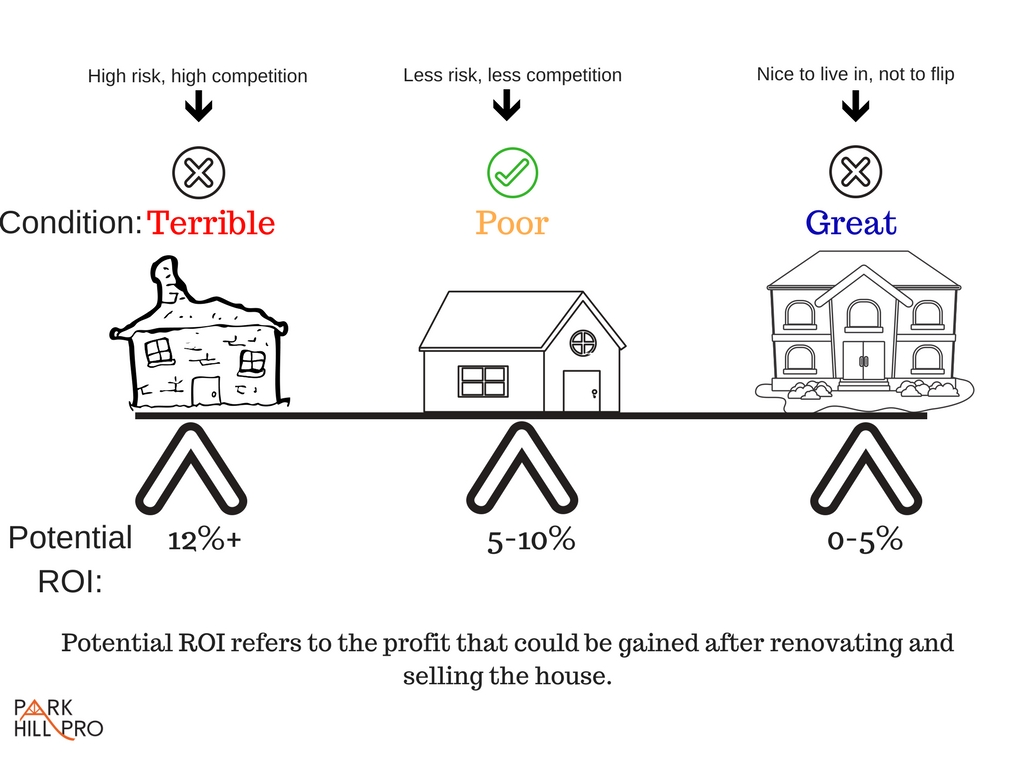

Finding the House: While it may seem tempting to target homes that are in really bad shape and have a higher profit potential, these can quickly become money-pits for the part-time investor. Why? Because homes in terrible condition with room for a 12%+ return on investment get a lot of bids from contractor-investors. These are individuals who have their own construction teams and can afford to offer a higher purchase price because their renovation costs are low. A general rule for real estate investing is: you make your profit on the purchase not the sale. In other words, if you buy the property at too high of a purchase price, you’ll never see a profit. Many amateur investors in Denver lose huge sums of money trying to compete for these homes in terrible condition. Our goal is to make money safely. The way we do this is by identifying properties just beneath the radar for both traditional investors, and most home-buyers. These are homes that are in poor condition, with an opportunity for around 8-10%.  8-10% isn’t a huge profit margin, but it’s a great starting point that can be maximized with the following strategies:

8-10% isn’t a huge profit margin, but it’s a great starting point that can be maximized with the following strategies:

1.) Live-in Flip: Living in a home that you will renovate and resell later is the most affordable way to flip a house. Housing is something you have to pay for anyway, you might as well profit from it.

To do this without getting your hands dirty, you can use an FHA 203k loan or a conventional loan with a renovation budget to cover both the purchase of the home AND the cost to renovate it. The only catch here is that the lender will probably require the work to be done by a general contractor.

If you’re handy, the other option is to do the renovation work yourself. This can be done using a conventional loan to purchase the property and a third-party renovation loan to finance the construction. Home Depot offers a loan program like this, for example.

Doing the work on your own will allow you to cut renovation costs and maximize profit. Alternatively, using a General Contractor to complete renovations prior to move in means you get to experience the dream home without the mess. In either case, our goal will be to gain equity from renovation and (hopefully) market appreciation over 12 months. If you picked up 8% after renovating and 7% appreciation by owning the home for a year, ROI would be 15%. So if your initial investment was $300,000, you would gain $45,000 after selling with some market appreciation, or $24,000 if the market didn’t appreciate at all. These are gains that you could pocket as income, or reinvest into your next property.

By the way, financing $300,000 with 3.5% down ($10,500) at 4% interest on a 30-year loan would be about $1,382/mo according to Google’s loan calculator.

2.) Rental Flip: If you already own your home and want an additional investment property, the rental flip can be a great choice. This follows the same logic as the live-in flip, except that you the owner will not be the one living in the property.

This is done by purchasing and renovating the property, and then renting it out for 12 months. The rental income should cover the monthly mortgage costs plus a little extra. The advantage of selling after 12 months is the ability to pay capital gains tax instead of income tax (ask your accountant about this).

Usually loans for non owner-occupied properties require a larger down payment. In my experience, 15% is a common number for minimum down-payment on investment loans.

As with the live-in flip, the goal is to gain equity through renovating the property and gaining appreciation over the year.

3.) Airbnb: Although Denver recently made it illegal to short-term rent non owner-occupied properties, you can still Airbnb the home that you live in!

To do this, find a home with a separate entrance for the basement, in a neighborhood that is a desirable area on Airbnb.com. Use the renovation budget to renovate both the main level and basement, building a basement bathroom and installing egress windows if needed. You’ll also need to insulate the basement ceiling to reduce noise from above.

Here in Park Hill, these basement/garden level “apartments” rent for between $90-$150 per night depending on season. So, just renting out your basement for 15 days a month could nearly cover the entire monthly cost of the loan! You’ll still gain equity from renovations and market appreciation, using Airbnb could allow you to live for free.

Investing in Denver real estate isn’t easy or simple, but it’s a great way to slowly build a fortune.

-Erik