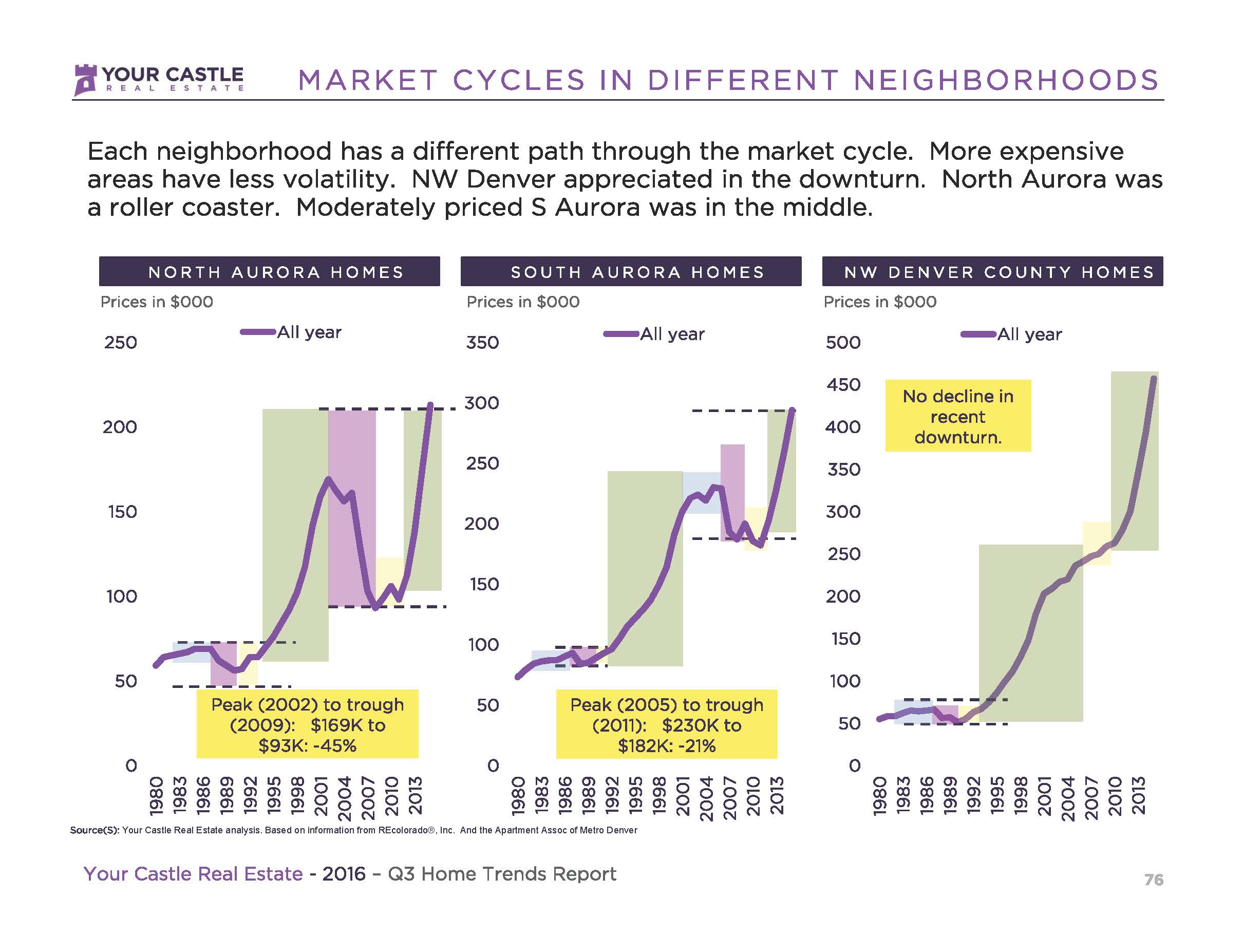

When I bought my home in 2015, some said it was crazy to buy real estate in Denver’s expensive market. Since then, the house has appreciated by $90,000, while rent has only gotten higher. Is there a Denver real estate bubble? Some people believe that when home prices rise for several years, a crash is imminent. While it is true that the nation-wide real estate market shifts every 7 years or so, this is not true for individual markets. For example, North West Denver continued to climb upward, even during the worst years of the recent housing collapse:

The media has also played a role in stoking the public’s housing fears. For example, this recent Denver Post article titled: “Metro Denver home prices more overvalued than any time since the 1980s,” sounds concerning. But when you actually read the article it says: “There is a very low risk of price declines. It is a hot market… Denver is not a concern. Colorado is not a concern.”

There are a lot of opinions out there, but to understand whether or not there is a Denver real estate bubble, we should look at the numbers. We can’t predict the future, but past and present trends can help us make data-driven decisions in our real estate investments. These slides are taken from the iHomes Colorado trends class, free to the public and taught by Charles Roberts, President. Park Hill Pro is the largest independent real estate brokerage in Denver. We are a local company that specializes in the Denver market.

Hyper Local Markets

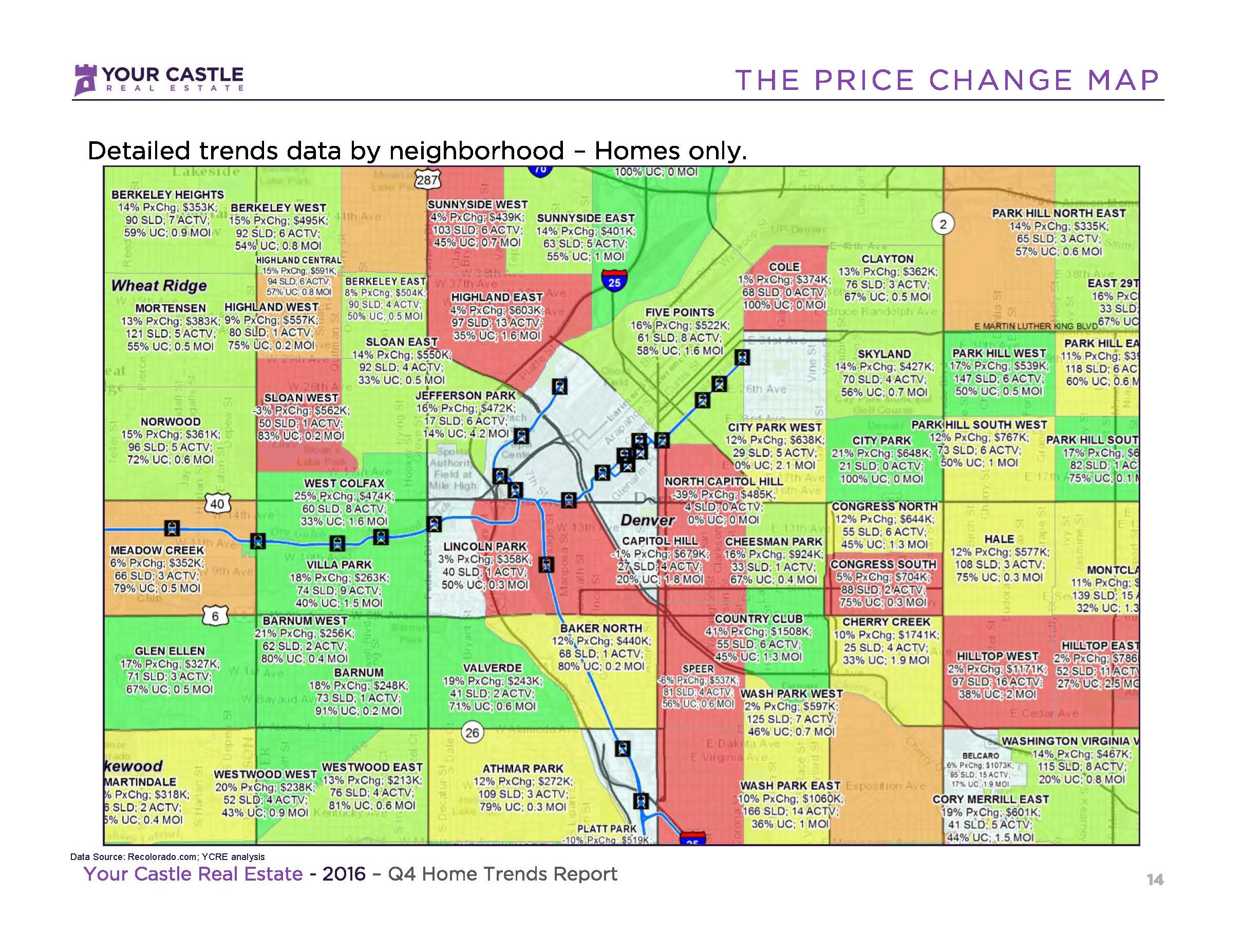

Over the past year, different neighborhoods have risen and fallen in value. A 300k property in Cap Hill purchased 12 months ago might have fallen in value by -1% or -$3,000. At the same time, a 300k property in West Park Hill may have appreciated by +17% or $51,000. The concept of an overall Denver real estate bubble is too broad, different neighborhoods go up and down in different ways every year.

Supply and Demand

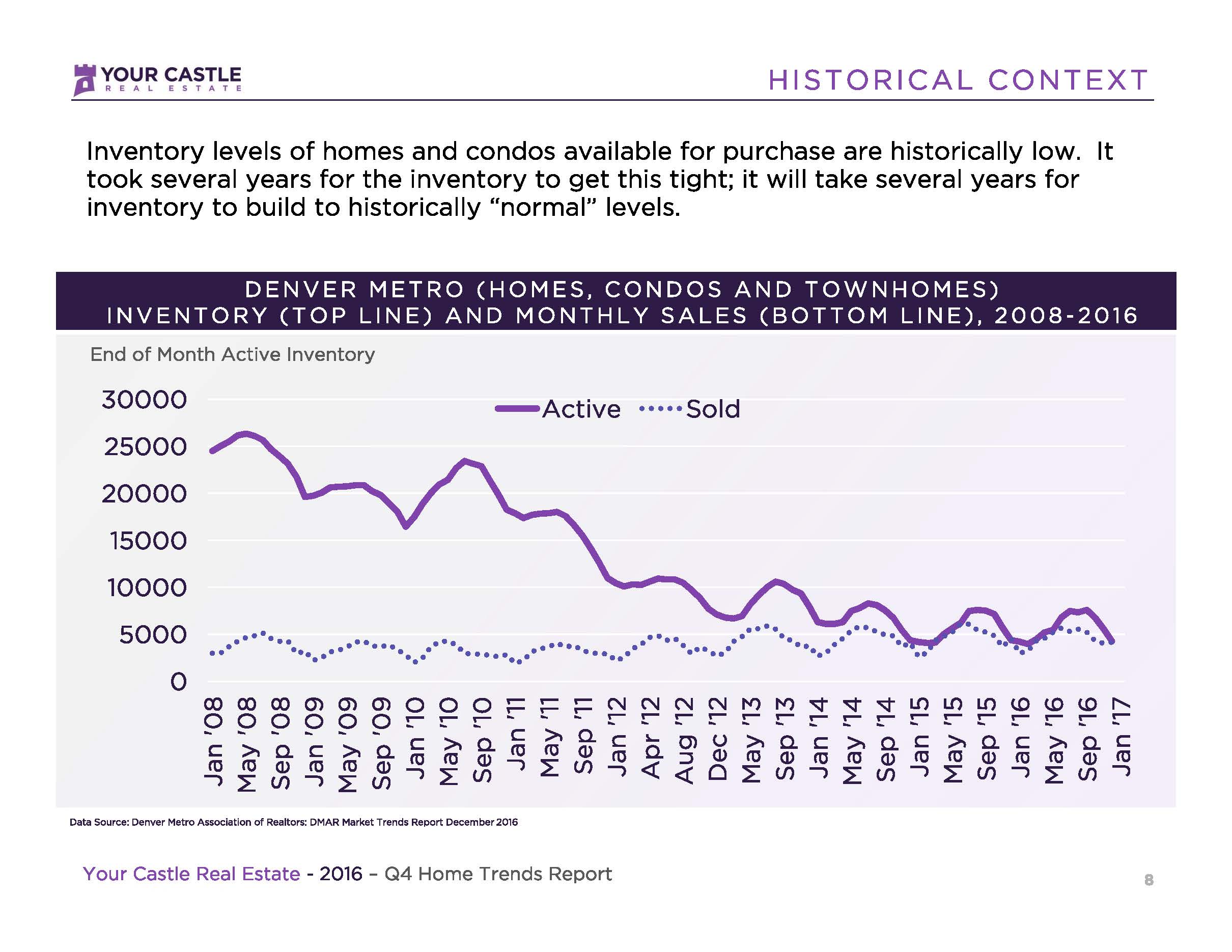

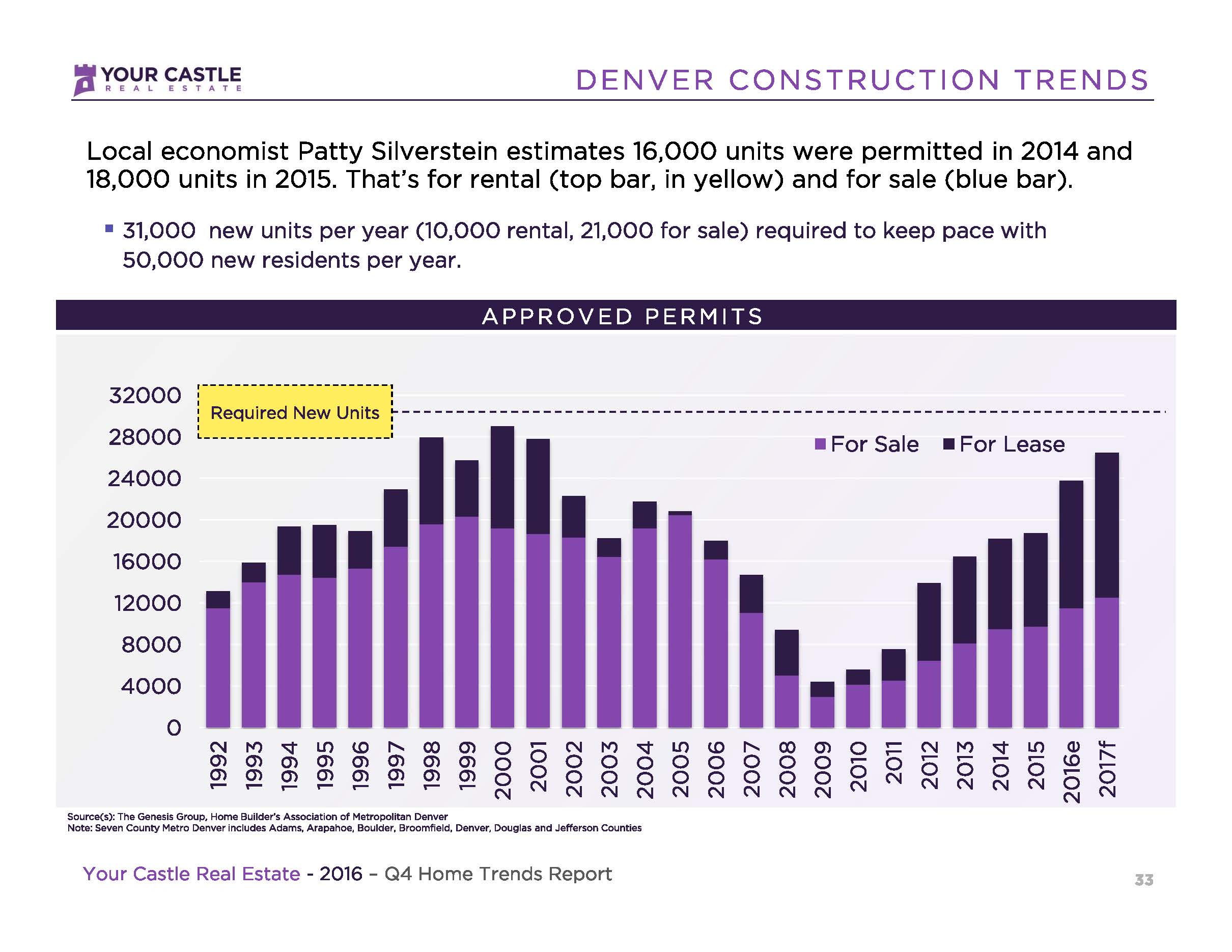

A “bubble burst” happens when there is more supply than demand. The graph below illustrates the relationship between active listings and houses that have sold. Currently, Denver simply does not have the inventory to match the demand. In order for a Denver real estate bubble to cause a market collapse, we need more supply, and less demand.

Inventory will continue to be a problem for the next several years as there still isn’t enough new supply to satisfy existing demand.

Historical Context

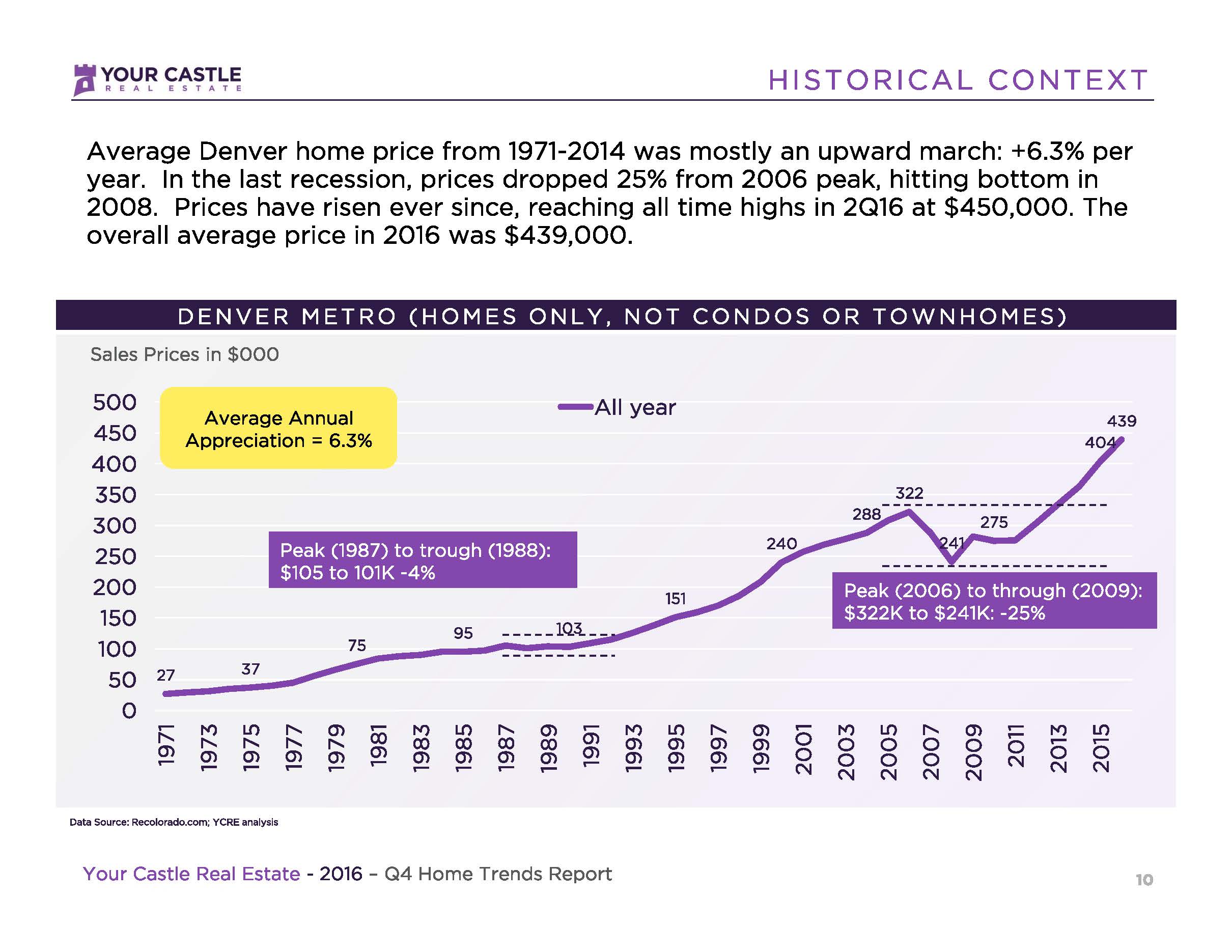

For the past 40 years, Denver has seen a consistent upward trend in home appreciation. Average annual appreciation since 1971 is about 6% without inflation or 2% if you account for inflation.

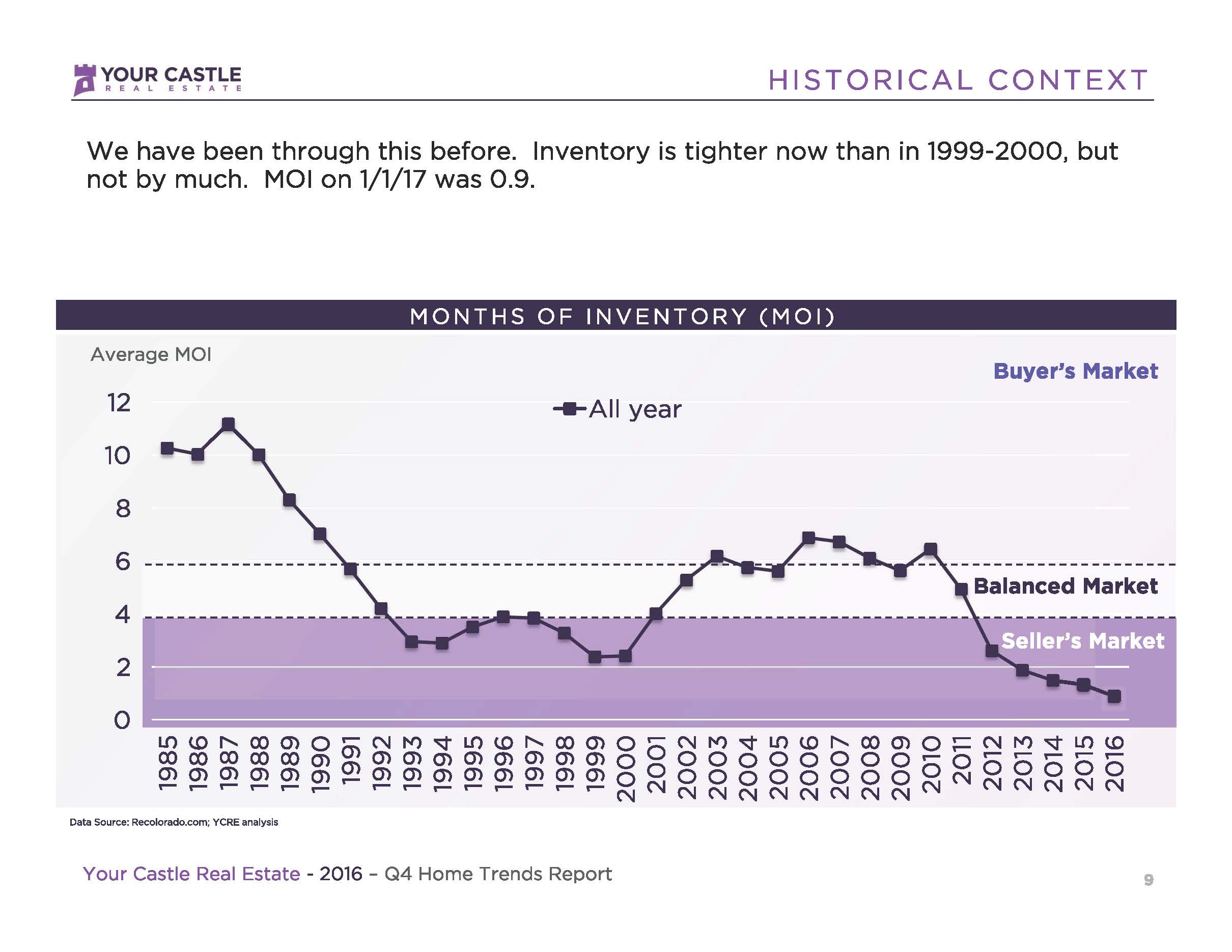

Seller’s Market

As the graph below illustrates, months of inventory in the years leading up to up to the last market crash was around 6 months. Currently, months of inventory is below 1 month! High demand and low inventory means it’s very unlikely to see a repeat of a crash like 10 years ago anytime soon. The market in 2008 had low demand and high inventory. We currently have the opposite problem. These aren’t the market conditions you would expect to see in a Denver real estate bubble burst.

So, is there a Denver real estate bubble? We can’t predict the future, but based on current levels of supply and demand, I think the market will continue to appreciate over the next few years until inventory levels rise to meet demand or until mortgage rates rise to a level high enough to really affect purchasing ability. As of now, mortgage rates are low and inventory is low, and it’s still a great time to own Denver real estate.