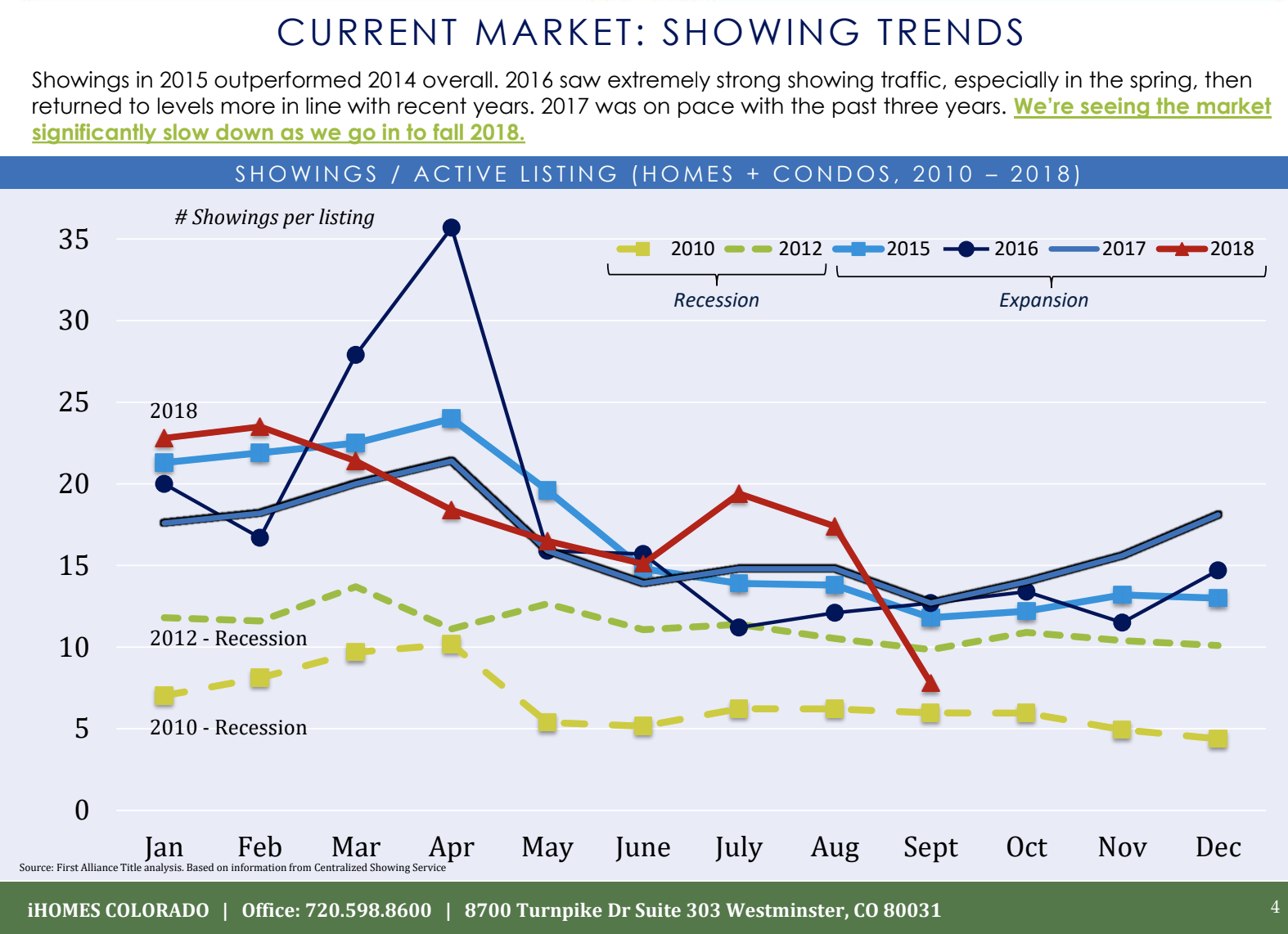

Denver Colorado, one of the hottest markets in the country, has just seen its biggest slowdown in the past 6 years. The change has shocked home-owners and seasoned brokers alike, who did not think such a sharp change was possible over such a short period of time.

It seems like only yesterday that buyers were offering up to 10% above list price to get a home under contract. Now, just a few months later, price reductions and seller concessions are becoming the new normal, in a market where buyers are finding themselves in better positions to negotiate than in recent memory.

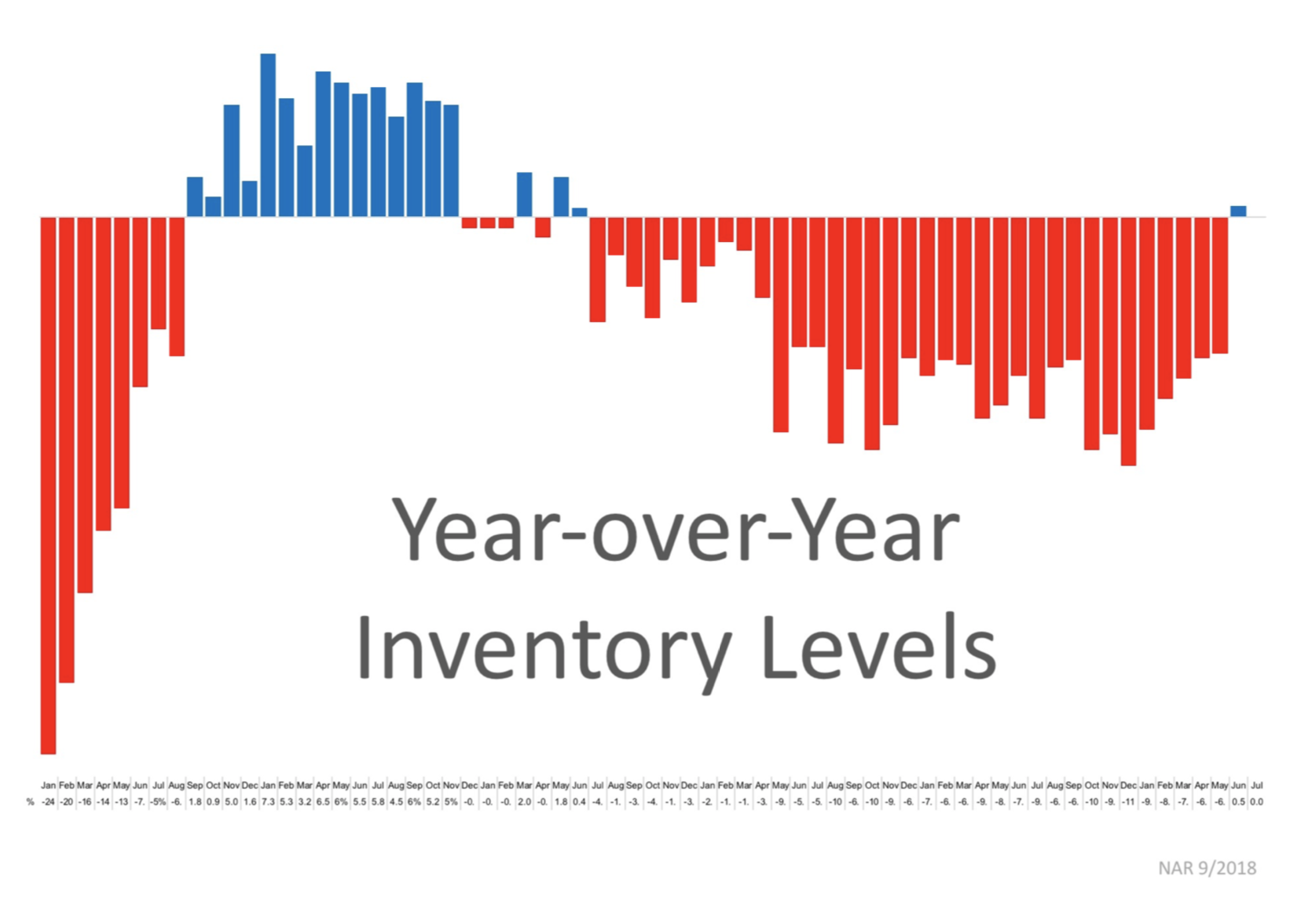

Rising levels of inventory and rising interest rates are some of the factors that have doubled Denver’s Months of Inventory (MOI) from about 1 month to almost 2 months. MOI, the measurement of the relationship between homes for sale and home sales, determines a “sellers market” at below 4 MOI, a “balanced market” between 4-6 MOI, and a “buyers market” at above 6 months of inventory. In more colloquial terms, we’ve shifted from a market where a home could sell in 2-3 days, to 2-3 weeks. However, a portion of current listings have been on the market for more than a few months.

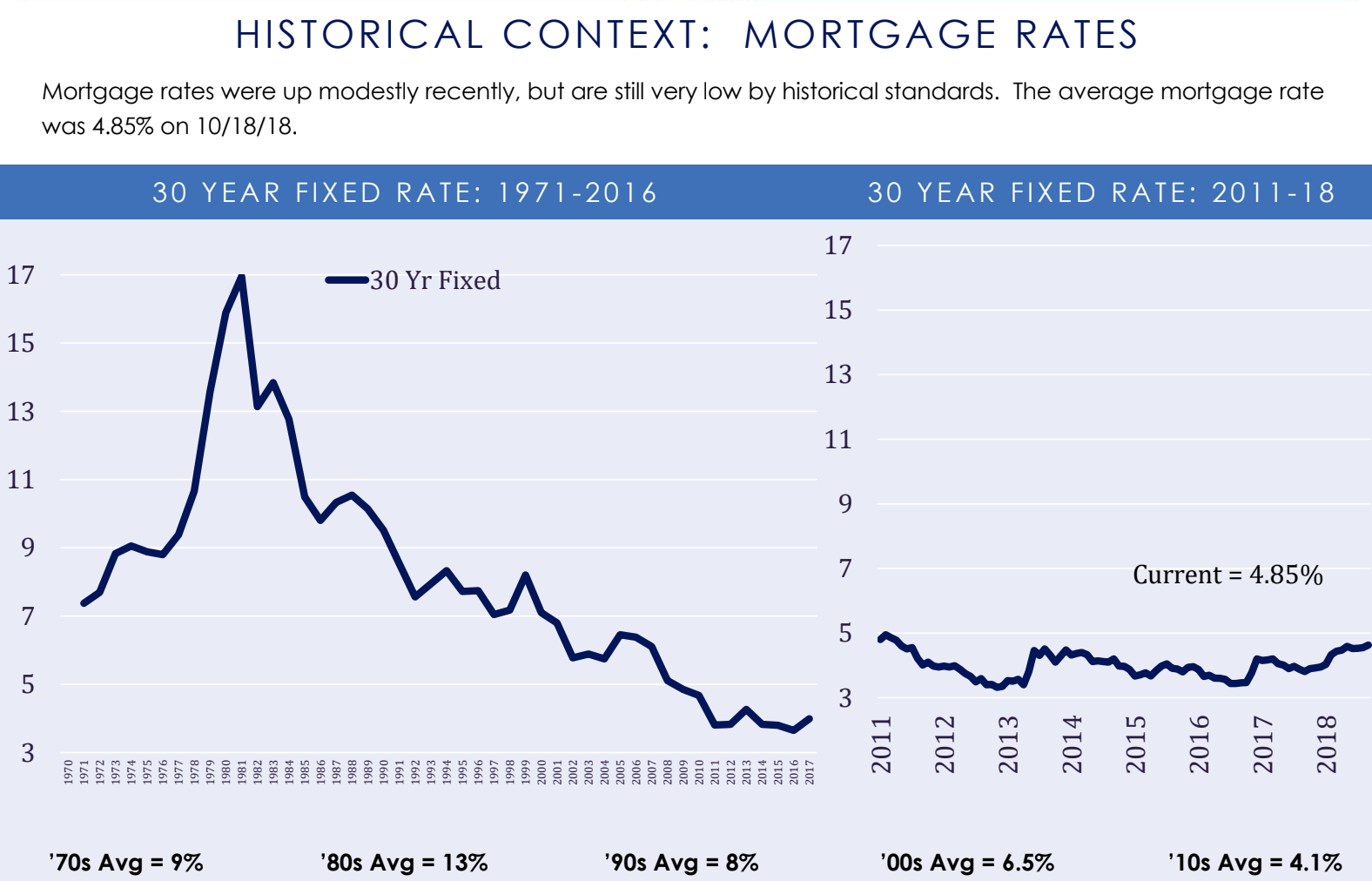

Interest rates, which seem to be slowly climbing up, will become more and more of a market factor as buyers come to terms with the reality of higher interest rates and sellers adjust prices accordingly. For example, a $300,000 home with 10% down using the current interest rate of around 4.75%, would put monthly mortgage payments at around $1700/mo. With an interest rate just two points higher (6.75%) that same home would cost close to $2,050/mo. For this reason, even if home prices stagnate or slightly decrease, buyers can expect to pay as much or more monthly with higher interest rates in the future.

Due to the nature of inventory levels and interest rates, we find ourselves in a middle market, where it is both a good time to buy as well as sell. This will likely change in the coming 12-18 months, as more listings flood the market with sellers trying to capitalize in the changing tide, and buyers discovering their budgets slashed through the rise of interest rates.

Curious what your home is worth? Find out here!